|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

Trump Gave Lithium Americas His ‘Magic Touch.’ This Analyst Still Says It’s Time to ‘Sell’ LAC Stock ASAP.

Lithium Americas (LAC) is a mining company developing the Thacker Pass lithium mine in northern Nevada, the largest known lithium deposit in the United States. The company’s operations focus on supplying battery-grade lithium carbonate to North America’s critical minerals supply chain, supporting a transition toward renewable energy and electric vehicles. Lithium Americas is a Canadian company headquartered in Vancouver. Lithium Americas StockLithium Americas has delivered remarkable gains, surging 18% in the last five days, 188% for the month, 241% over six months, and 198% across the past 52 weeks. This far outstrips the lithium mining industry’s average annual growth rate of 7-12% and impressive sector advances, fueled by electric vehicle (EV) demand and government investment. LAC stock is trading near its 52-week high, reflecting investor optimism about its Thacker Pass project and recent U.S. government support.

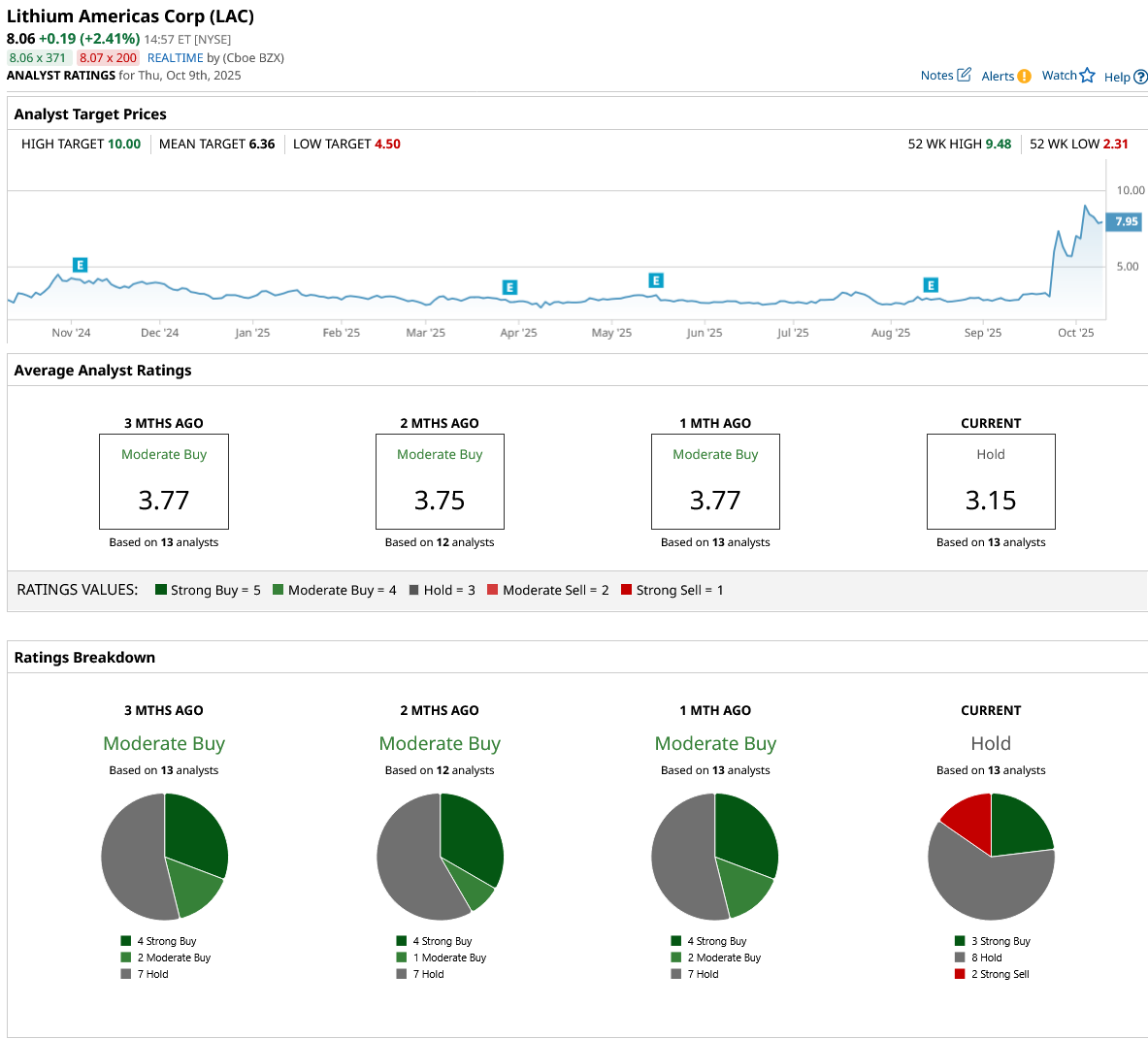

Lithium Americas Q2 ResultsLithium Americas reported a Q2 2025 adjusted loss of $0.06 per share, underperforming analyst consensus estimates of $0.04 per share. The company did not book any commercial revenue this quarter, continuing its pre-production phase, while transactional and advisory costs weighed on bottom-line results. The net loss for the first half was $24.8 million, reflecting ongoing high expenses associated with project development and financial arrangements. Diving into its financials, Lithium Americas capitalized $124.8 million in construction and project-related costs for Thacker Pass, bringing total capitalized costs to $574.1 million by June 30. The company ended Q2 with $509.1 million in cash and restricted cash, bolstered by $220 million in new investments and proceeds from an at-the-market equity program. Total assets grew to $1.34 billion, driven by these cash inflows and capital investments, although most funds are earmarked for the Thacker Pass buildout. Looking forward, Lithium Americas remains focused on completing Phase 1 of Thacker Pass by late 2027. Management expressed confidence in hitting future milestones, citing resolved legal hurdles, ongoing steel fabrication, essential long-term contracts, and increased workforce projections. The company expects further progress in construction, equipment procurement, and U.S. supply chain partnerships as production nears. Analyst Warns Against LACLAC stock fell 3.2% on Monday after Scotiabank downgraded it to “Sector Underperform” from “Sector Perform” and set a $5 price target, signaling a 37% downside potential from the current market price, citing excessive valuation following a staggering 200% rally over the past two weeks. Analyst Ben Isaacson acknowledged that the firm underestimated how strongly investors would react to government intervention, specifically the Donald Trump administration’s support for critical minerals. Isaacson argued that “Trump’s magic touch” had become a driving force in a highly speculative lithium market, yet warned that government backing could dilute shareholder value over time. He further noted that investors seem to view the Department of Energy’s involvement as a safety net against project delays and cost overruns, believing LAC is “too important to fail.” In response to heightened market optimism, Scotiabank employs a 2x NAV multiple to reflect hopes of a supply deficit but advises caution. The bank encourages stakeholders to take profits now after the exceptional run, then revisit the stock at lower levels when the market corrects and broader concerns about lithium price sustainability return. The downgrade signals growing skepticism about long-term upside and highlights elevated execution risk and uncertain price floors in the volatile lithium sector. Should You Bet on LAC?Despite the rally, Wall Street experts seem to agree with Scotiabank, as the consensus rating on LAC dropped from “Moderate Buy” last month to “Hold” this month, with a mean price target of $6.36 reflecting a downside of 44% from the current price. The stock has been covered by 13 analysts with three “Strong Buy” ratings, eight “Hold” ratings, and two “Strong Sell” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|