|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

What to Expect From United Parcel's Q3 2025 Earnings Report/United%20Parcel%20Service%2C%20Inc_%20logo%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

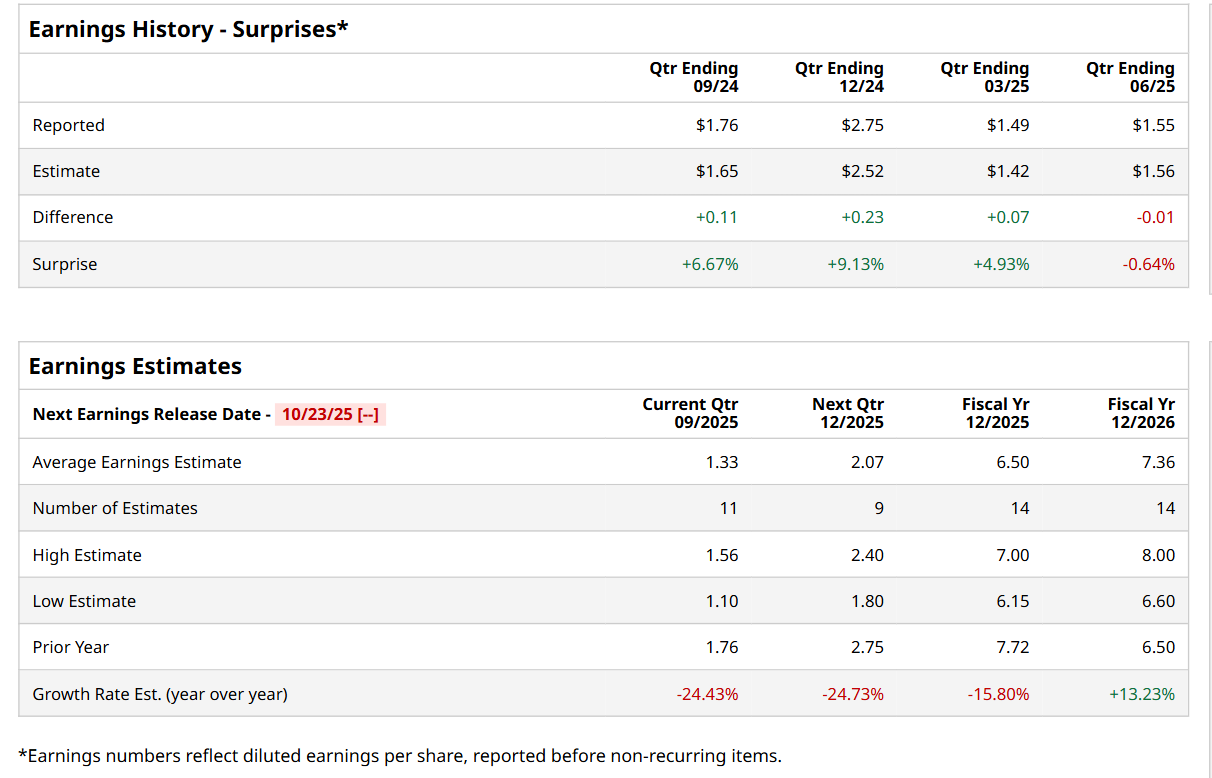

Valued at a market cap of $72.9 billion, United Parcel Service, Inc. (UPS) is a package delivery, logistics, and supply‐chain management company based in Atlanta, Georgia. It offers a broad range of services covering ground, air, and international shipping, as well as freight forwarding, contract logistics, and healthcare distribution. It is scheduled to announce its fiscal Q3 earnings for 2025 before the market opens on Tuesday, Oct. 28. Ahead of this event, analysts expect this freight and logistics company to report a profit of $1.33 per share, down 24.4% from $1.76 per share in the year-ago quarter. The company has surpassed Wall Street’s earnings estimates in three of the last four quarters, while missing on another occasion. In Q2, UPS’ EPS of $1.55 fell short of the forecasted figure by a slight margin. For fiscal 2025, analysts expect UPS to report a profit of $6.50 per share, down 15.8% from $7.72 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound and grow by 13.2% year-over-year to $7.36 in fiscal 2026.

Shares of UPS have declined 34.5% over the past 52 weeks, significantly underperforming both the S&P 500 Index's ($SPX) 17.9% uptick and the Industrial Select Sector SPDR Fund’s (XLI) 14.1% return over the same time frame.

UPS announced mixed Q2 earnings results on Jul. 29, with its revenue of $21.2 billion surpassing consensus estimates by 1.8%. However, its adjusted EPS declined 13.4% from the year-ago quarter to $1.55 and came in marginally below the analyst expectations of $1.56. Lower operating profits across all three reportable segments pressured the company’s overall profitability. Adding to investor concerns, UPS once again withheld its full-year outlook, citing ongoing macroeconomic uncertainty. This cautious stance, combined with weaker earnings, triggered a sharp 10.6% drop in its stock price following the earnings announcement. Wall Street analysts are moderately optimistic about UPS’ stock, with a "Moderate Buy" rating overall. Among 30 analysts covering the stock, 13 recommend "Strong Buy," one indicates a "Moderate Buy," 13 suggest "Hold,” one advises a "Moderate Sell,” and two suggest “Strong Sell” ratings. The mean price target for UPS is $102.07, implying an 18.7% potential upside from the current levels. On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|