|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

What to Expect From Welltower’s Next Quarterly Earnings Report

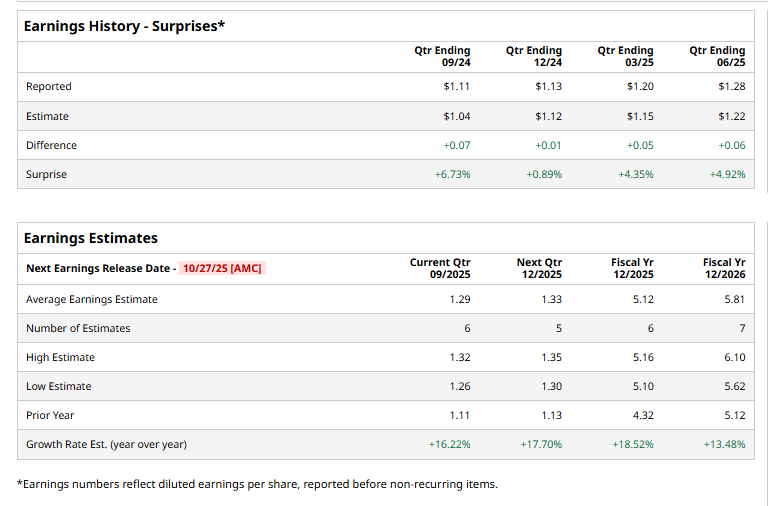

Welltower Inc. (WELL) is a leading Ohio-based real estate investment trust (REIT) that focuses on healthcare infrastructure, including senior housing, post-acute care facilities, and outpatient medical properties. With a market cap of $116.5 billion, the company invests in and manages a diversified portfolio of properties across the United States, Canada, and the U.K. The healthcare REIT is expected to release its Q3 results after the market closes on Monday, Oct. 27. Ahead of the event, analysts expect Welltower to report normalized funds from operations (NFFO) of $1.29 per share, up 16.2% from $1.11 per share reported in the year-ago quarter. Moreover, the company has surpassed Wall Street’s NFFO projections in each of the past four quarters. For fiscal 2025, analysts expect WELL to deliver an NFFO of $5.12 per share, marking an 18.5% increase from $4.32 per share reported in fiscal 2024. In fiscal 2026, its NFFO is expected to grow 13.5% year-over-year to $5.81 per share.  WELL stock has soared 39.2% over the past 52 weeks, significantly outperforming the S&P 500 Index’s ($SPX) 17.9% gains and the Real Estate Select Sector SPDR Fund’s (XLRE) 3.9% fall during the same time frame.  On September 16, Welltower shares fell over 2% amid a broad sell-off in healthcare stocks after Wells Fargo & Company (WFC) downgraded the sector from “Neutral” to “Unfavorable.” Moreover, the stock maintains a consensus “Strong Buy” rating. Of the 21 analysts covering the WELL stock, opinions include 15 “Strong Buys,” two “Moderate Buys,” and four “Holds.” Its mean price target of $188.05 suggests a modest 8.7% upside potential from current price levels. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|