|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

What to Expect From SBA Communications’ Q3 2025 Earnings Report

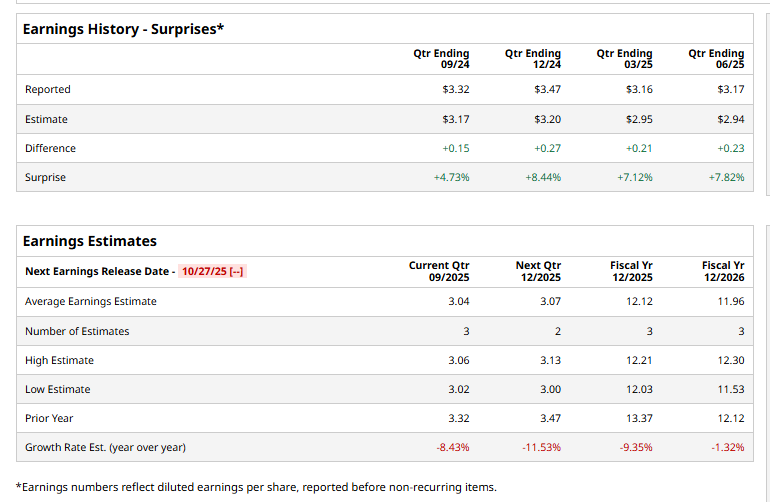

With a market cap of around $20.3 billion, SBA Communications Corporation (SBAC) is a Florida-based wireless infrastructure company that owns and operates a portfolio of communication towers and related sites. The company provides tower space and services to wireless carriers, enabling reliable mobile connectivity across the United States, Latin America, and Canada. SBAC is scheduled to report its Q3 earnings soon. Ahead of the event, analysts expect the company to report an AFFO of $3.04 per share, down 8.4% from $3.32 per share in the same quarter of the previous year. The company has surpassed Wall Street's bottom-line estimates in the past four quarters. For fiscal 2025, analysts expect SBAC to report an AFFO of $12.12 per share, down 9.4% from $13.37 in fiscal 2024.  Over the past 52 weeks, SBAC stock has struggled, with its stock dipping 20.7%, underperforming the Real Estate Select Sector SPDR Fund’s (XLRE) 3.9% drop and the S&P 500 Index’s ($SPX) 17.9% return during the same time frame.  On Aug. 4, SBAC reported its Q2 results, and its shares closed down by 4.9% in the following trading session. The company posted adjusted FFO per share of $3.17, surpassing Wall Street estimates of $3.12, while revenue of $699 million beat expectations of $670.1 million. Looking ahead, SBAC projects full-year FFO between $12.65 and $13.02 per share and revenue in the range of $2.78 billion to $2.83 billion, reflecting continued growth in its wireless infrastructure portfolio. Wall Street analysts are cautiously optimistic about SBAC’s stock, with an overall "Moderate Buy" rating. Among 20 analysts covering the stock, eight recommend "Strong Buy," one suggests a “Moderate Buy,” and 11 suggest a “Hold.” The average analyst price target of $245,61 implies an upswing potential of 30.3% from the prevailing price levels. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|