|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

Arch Capital Earnings Preview: What to Expect/Arch%20Capital%20Group%20Ltd%20logo%20and%20data-%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

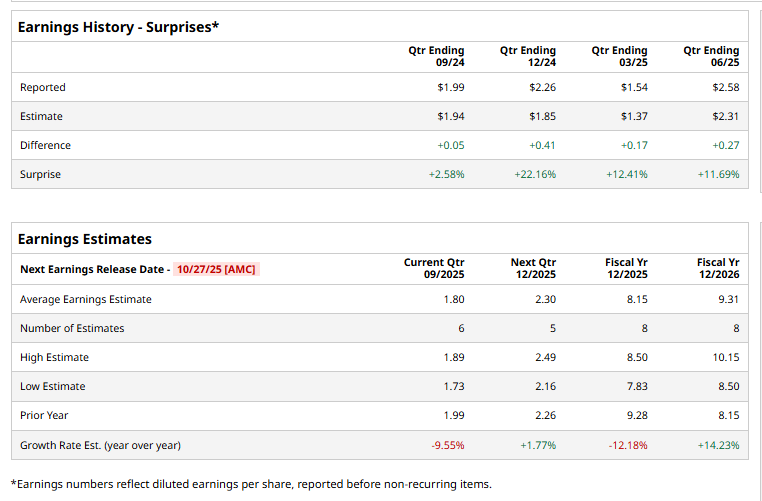

With a market cap of $34.1 billion, Arch Capital Group Ltd. (ACGL) is a prominent financial services company. Headquartered in Pembroke, Bermuda, it offers life, health, property, and reinsurance insurance products, as well as mortgage insurance products. The insurance giant is expected to announce its fiscal third-quarter earnings for 2025 after the market closes on Monday, Oct. 27. Ahead of the event, analysts expect ACGL to report a profit of $1.80 per share on a diluted basis, down 9.6% from $1.99 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports. For the current year, analysts expect ACGL to report EPS of $8.15, down 12.2% from $9.28 in fiscal 2024. However, its EPS is expected to rise 14.2% year over year to $9.31 in fiscal 2026.

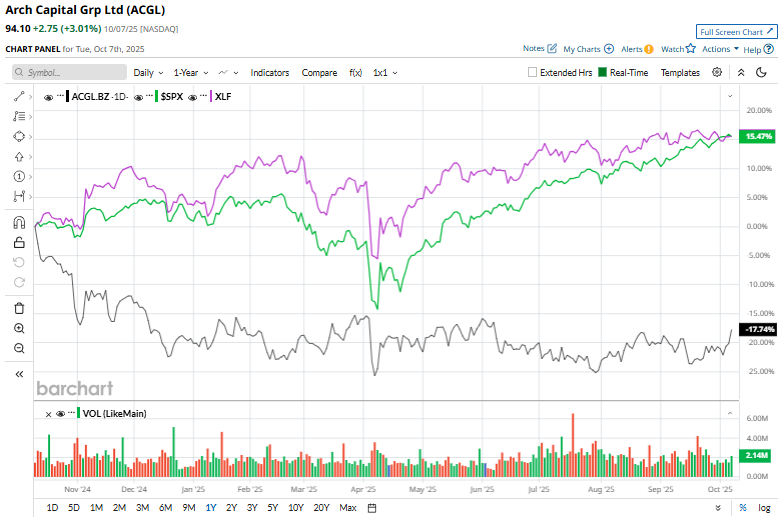

ACGL stock has dropped 12.7% over the past 52 weeks, underperforming the S&P 500 Index’s ($SPX) 17.9% gains and the Financial Select Sector SPDR Fund’s (XLF) 19.3% gains over the same time frame.

On Jul. 29, Arch Capital Group released its Q2 2025 earnings, and its shares dipped marginally. The company demonstrated a disciplined underwriting strategy and effective capital management, driving a 15% year-over-year increase in net premiums written to $4.35 billion, exceeding Wall Street expectations. Underwriting income rose 7.3% year-over-year to $818 million, underscoring strong operational execution. Additionally, adjusted EPS of $2.58 came in 11.7% above consensus estimates, highlighting the company’s robust profitability. Analysts’ consensus opinion on ACGL stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 20 analysts covering the stock, ten advise a “Strong Buy” rating, nine give a “Hold,” and one recommends a “Strong Sell.” ACGL’s average analyst price target is $107.18, indicating a potential upside of 13.9% from the current levels. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|