|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

Labcorp Holdings’ Q3 2025 Earnings: What to Expect/Labcorp%20Holdings%20Inc_%20location-by%20Sundry%20Photography%20via%20iStock.jpg)

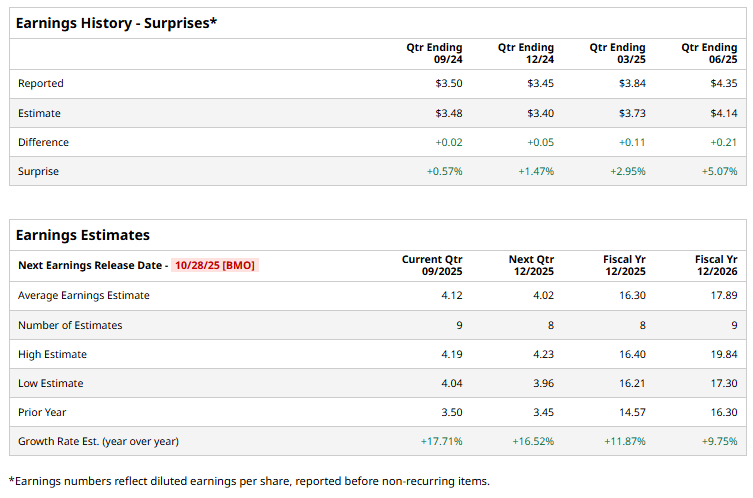

With a market cap of $22.9 billion, Labcorp Holdings Inc. (LH) is a leading global life sciences company that provides comprehensive diagnostic, drug development, and laboratory services. Headquartered in Burlington, North Carolina, Labcorp operates a network of laboratories and testing facilities, offering services ranging from routine clinical testing to advanced genomics and clinical trial solutions. LH is scheduled to report its Q3 earnings on Tuesday, Oct. 28, before the market opens. Ahead of the event, analysts expect the company to report a profit of $4.12 per share, representing a 17.7% increase from $3.50 per share in the same quarter of the previous year. The company has surpassed Wall Street's bottom-line estimates in each of the past four quarters. For fiscal 2025, analysts expect LH to report earnings of $16.30 per share, up 11.9% from $14.57 in fiscal 2024. Moreover, the earnings are expected to rise 9.8% year-over-year to $17.89 per share in fiscal 2026.

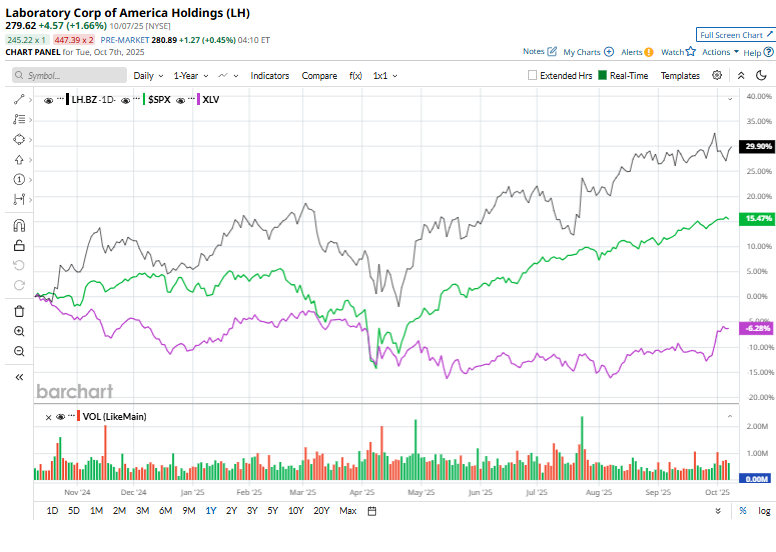

LH stock has soared 31.9% over the past 52 weeks, outperforming the S&P 500 Index's ($SPX) 17.9% gain and the Health Care Select Sector SPDR Fund’s (XLV) 4.5% decline over the same time frame.

Shares of Labcorp Holdings climbed 6.9% on Jul. 24 after the company posted strong Q2 2025 results. Its adjusted EPS of $4.35 and revenues of $3.53 billion topped the consensus estimates. Growth was driven by strong results in Diagnostics Laboratories, which climbed 8.9% to $2.75 billion, and Biopharma Laboratory Services, which increased 11% to $784.8 million. Analysts’ consensus opinion on LH stock is highly optimistic, with an overall “Strong Buy” rating. Out of 18 analysts covering the stock, 14 advise a “Strong Buy” rating and four recommend a “Hold.” The stock’s average analyst price target is $296.70, indicating a 6.1% potential upside from the current levels. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|