|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

F5's Q4 2025 Earnings: What to Expect/F5%20Inc%20HQ%20logo-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

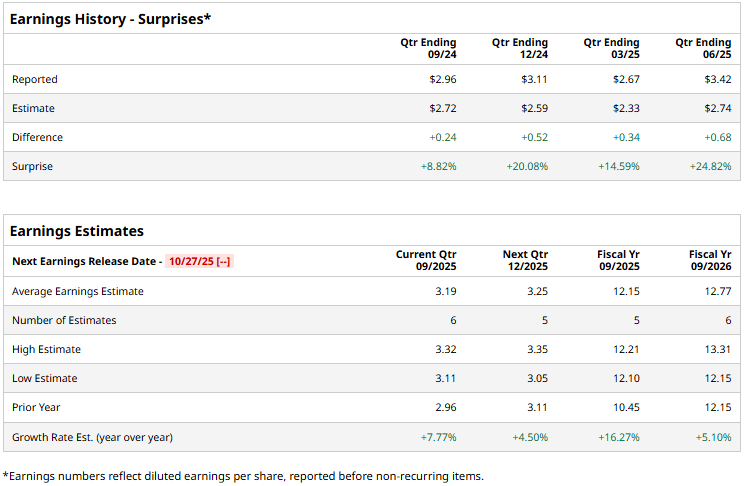

Seattle-based F5, Inc. (FFIV) provides multi-cloud application security and delivery solutions. Its application, delivery, and networking products improve the performance, availability, and security of applications running on networks that use the Internet Protocol. With a market cap of $18.9 billion, F5’s operations span the United States, Indo-Pacific, Europe, the Middle East, and internationally. The tech major is expected to announce its fourth-quarter results after the markets close on Monday, Oct. 27. Ahead of the event, analysts expect F5 to deliver an adjusted profit of $3.19 per share, up 7.8% from $2.96 per share reported in the year-ago quarter. The company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters. For the full fiscal 2025, F5’s adjusted EPS is expected to come in at $12.15, up 16.3% from $10.45 reported in 2024. While in fiscal 2026, its earnings are expected to grow 5.1% year-over-year to $12.77 per share.

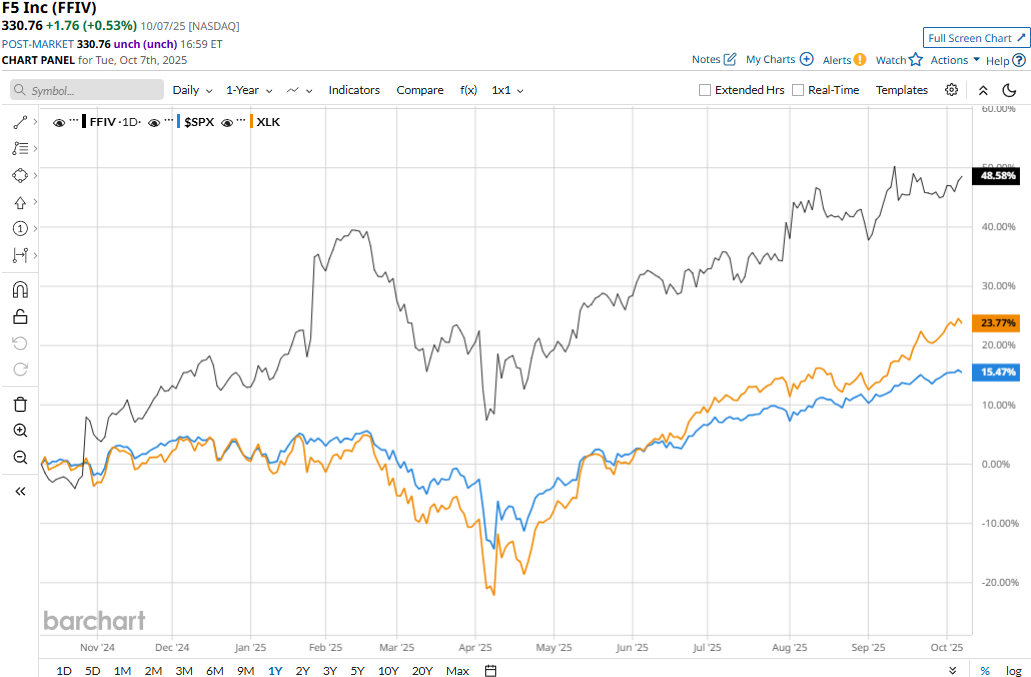

F5’s stock prices have soared 51.7% over the past 52 weeks, significantly outpacing the Technology Select Sector SPDR Fund’s (XLK) 27.7% gains and the S&P 500 Index’s ($SPX) 17.9% returns during the same time frame.

F5’s stock prices surged 4.8% in the trading session following the release of its impressive Q3 results on Jul. 30. Driven by a 39% surge in systems revenues and 16% growth in software revenues, the company’s product revenues shot up 26% year-over-year to $388.8 million. Meanwhile, its overall topline came in at $780.4 million, up 12.2% year-over-year and 3.6% above the Street’s expectations. Further, driven by solid margin expansion, F5’s adjusted net income soared 22.3% year-over-year to $243.2 million, beating the consensus estimates by a large margin. Nevertheless, analysts remain cautious about the stock’s prospects. FFIV maintains a consensus “Hold” rating overall. Of the 13 analysts covering the stock, opinions include two “Strong Buys,” one “Moderate Buy,” nine “Holds,” and one “Moderate Sell.” As of writing, F5 is trading above its mean price target of $326.40. On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|