|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

Dear GameStop Stock Fans, Mark Your Calendars for October 7

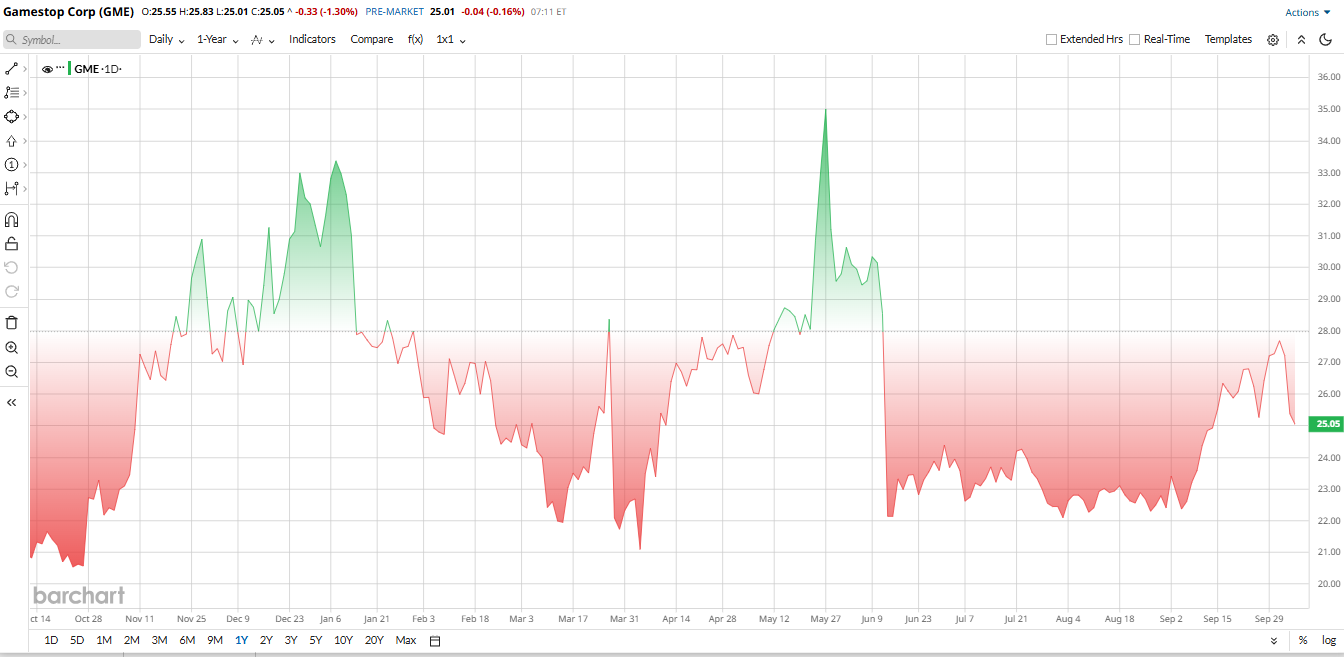

Meme stocks like GameStop (GME) continue to capture investor attention, even years after the retail-trading frenzy first made headlines. While GameStop’s share price has seen dramatic swings, the company still finds ways to keep shareholders engaged, and its latest announcement is one worth circling on the calendar. GameStop plans to distribute warrants to its common stockholders as of Oct. 3, with the official distribution set for today, Oct. 7. Each investor will receive one warrant for every ten shares owned, giving them the right to purchase GameStop stock at $32 per share. The company has also applied to list these warrants on the New York Stock Exchange under the ticker “GME WS.” For GameStop fans and investors alike, this upcoming warrant event could shape the stock’s next chapter, adding a new layer of excitement to one of the market’s most closely watched names. About GME StockValued at roughly $11 billion by market cap, GameStop is a specialty retailer focused on video games, consoles, collectibles, and digital entertainment products. Once the poster child of the meme-stock craze, GameStop continues to attract retail investors’ attention as it explores new strategies for expanding its online sales, collectibles, and digital initiatives to strengthen its position in the evolving gaming industry. GME stock has been down roughly 20% year-to-date (YTD), reversing last year’s gains as volatility returns to the meme-stock favorite. The stock plunged mainly due to weak sales, fading meme-stock momentum, ongoing losses, store closures, and investor doubts about its long-term turnaround and digital transition strategy. GameStop’s valuation sits in the middle zone. Its 32x price-to-earnings (P/E) looks higher than the sector median of 17x, but after adjusting for its large cash and crypto holdings, the stock appears more reasonable. With a price-to-book (P/B) above 2x, it’s fairly valued, not outright cheap.

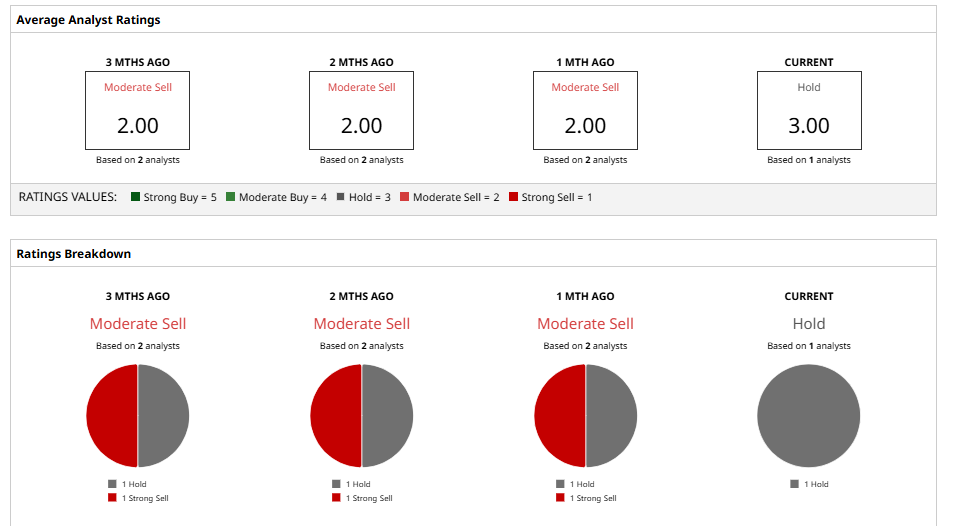

GameStop Calls It a Cash Raise Without DilutionGameStop recently announced a special dividend of warrants to shareholders. On Sept. 9, GameStop said that anyone holding its stock on the record date of Oct. 3 will receive one warrant for every ten shares they own. This special dividend will be distributed on about Oct. 7. Each warrant gives its owner the right to buy one share of GME stock at $32 any time through Oct. 30, 2026. The company says it expects to issue up to roughly 59 million of these warrants. GameStop plans to list the warrants (ticker “GME WS”) on the NYSE so they can be traded separately. The warrant dividend is essentially a way for GameStop to raise cash. If all the warrants are exercised, GameStop would collect about $1.9 billion by selling shares at the $32 price. Management says the proceeds will be used for general corporate purposes (for example, investments or possible acquisitions). The company calls this a “non-dilutive” raise since shareholders pay cash to get new stock. GameStop Beats Q2 Earnings EstimateGameStop surprised Wall Street with a strong Q2 report, marking a sharp turnaround. Revenue jumped 21.8% year-over-year (YoY) to $972.2 million, boosted by strong hardware sales, especially the new Nintendo Switch 2, and collectibles. The company swung to a GAAP net income of $168.6 million from $14.8 million a year earlier, while adjusted EPS rose to $0.25 from $0.01. Shares gained about 5% in after-hours trading following the announcement. The rebound came from aggressive cost-cutting, store closures, and about $80 million in interest income from its large cash position. In Q1, GameStop had already shown progress with $44.8 million in profit despite lower sales. Its financial position remains robust, holding $8.7 billion in cash and $4.16 billion in debt as of August 2025, giving it more cash than liabilities. Even stronger, by the end of Q2, the cash pile had ballooned to $8.7 billion. With a book value/share (BVPS) ratio of about 11, GameStop’s balance sheet looks exceptionally strong, positioning it well for potential growth or strategic moves. What Do Analysts Say About GME StockGME stock is currently covered by one Wall Street analyst tracked by Barchart. The analyst has given the stock a “Hold” rating and set a one-year target of about $13.5, which means Wall Street sees a nearly 50% downside from current levels. Their caution reflects that today’s profit largely comes from investments and cost cuts, not ongoing growth in core sales, plus the big planned share issuance.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|