|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

Principal Financial Earnings Preview: What to Expect/Principal%20Financial%20Group%20Inc%20logo%20on%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

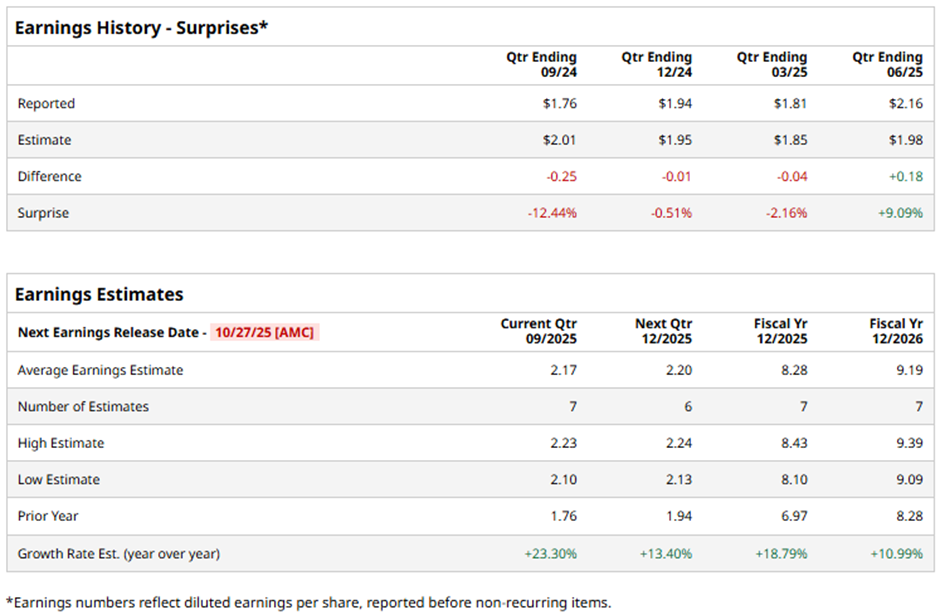

With a market cap of $18.8 billion, Principal Financial Group, Inc. (PFG) is a leading global investment management company providing retirement, asset management, and insurance products and services to businesses, individuals, and institutional clients. The company focuses on delivering comprehensive financial solutions through its diverse segments, with a strong emphasis on serving small and medium-sized businesses in the United States. The Des Moines, Iowa-based company is set to release its fiscal Q3 2025 results after the market closes on Monday, Oct. 27. Analysts expect PFG to report an adjusted EPS of $2.17 for the quarter, a 23.3% growth from $1.76 in the prior year's quarter. It has surpassed Wall Street's bottom-line estimates in one of the past four quarters while missing on three other occasions. For fiscal 2025, analysts forecast the financial services company to post adjusted EPS of $8.28, reflecting an 18.8% increase from $6.97 in fiscal 2024.

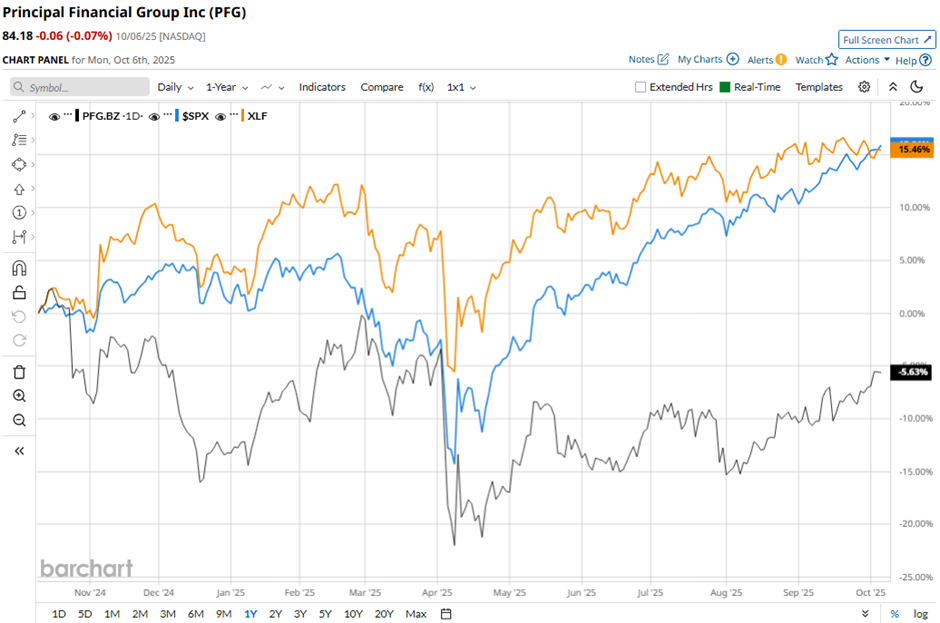

Shares of Principal Financial have decreased 3.6% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 17.2% gain and the Financial Select Sector SPDR Fund's (XLF) 19.2% increase over the period.

Despite reporting better-than-expected Q2 2025 adjusted EPS of $2.16 on Jul. 28, Principal Financial Group’s stock fell slightly the next day as adjusted revenue of $3.69 billion, missing estimates. Investors were also concerned about the 21.7% drop in Retirement and Income Solution revenues, the company’s largest segment, along with weaker-than-expected results in Life Insurance, where pre-tax earnings fell 15%. Analysts' consensus view on PFG stock is cautious, with an overall "Hold" rating. Among 15 analysts covering the stock, four recommend "Strong Buy," eight suggest "Hold," one indicates “Moderate Sell,” and two have a “Strong Sell” rating. The average analyst price target for Principal Financial is $86.23, indicating a potential upside of 2.4% from the current levels. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|