|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

Dear Tesla Stock Fans, Mark Your Calendars for October 7/Tesla%20charging%20station%20black%20background%20by%20Blomst%20via%20Pixabay.jpg)

Good news seems to keep rolling in for Tesla (TSLA) shareholders. After a tough few months, things are finally looking up for the company. Following signs of revival in Europe and a refocused Elon Musk, a new teaser video on the social media platform X (formerly Twitter) was posted by the company about a new product. Roadster, New Mass-Market Vehicle, or Something Else?Market chatter is that it can be one of two things. First, it is speculated that Tesla might finally be coming out with the Roadster that Musk has been teasing for years. First unveiled in November 2017, Musk made some bold promises about the yet-to-be-released Roadster at that time. From 0-60 mph in 1.9 seconds to a range of about 620 miles on a single charge. The base price for the “normal” version was to be about $200,000, and the first 1,000 Founder-Series units would cost about $250,000. Slated to be available in 2020, the Roadster has faced multiple characteristic Tesla delays. In 2021, Musk blamed supply chain issues. In early 2024, the CEO said production design would be completed and unveiled by the end of 2024, and deliveries would begin in 2025. Meanwhile, plans for a new mass-market model have been in the works for even longer. Way back in 2016, at a World Economic Forum event, Musk had envisioned building a more affordable EV for the masses. Although some would classify the Model 3 as the one for the masses, a car that costs about $42,500 is still unreachable for many, especially considering the end of the $7,500 EV tax credits. However, Musk had made references to a $25,000 car in 2020 that would be produced by Tesla. Fast forward to 2024, the expected mass-market model dubbed “Model 2” or “Redwood” (depending on who you ask) was supposed to have been in production by mid-2025, with ambitions to manufacture 10,000 such vehicles each week. This came to fruition according to the timeline (a rarity) when the company revealed to investors that it had started “first builds of a more affordable model in June.” The new model is expected to be smaller than the Model Y, with toned-down features. Overall, the ramping up of the mass-market model will be done later, and therefore, even if builds happen in 2025, mass availability may take more time. However, throwing curveballs and being unpredictable is second nature to Musk, and he may eventually go down an entirely different path. To that end, announcements regarding the company's humanoid robot Optimus, which Musk had described as a $10 trillion revenue opportunity, also cannot be ruled out. Additionally, Musk is big on AI, and any big revelations regarding the same are also within the realms of possibility by the world's richest man. Thus, the much-anticipated reveal today will be something that market observers will follow keenly, as it can have a profound impact not only on the Tesla share price in the short term (+12.2% YTD) but it can also throw light on the company's future strategic paths while giving an inkling as to how Musk goes about earning his mammoth $1 trillion proposed pay package.

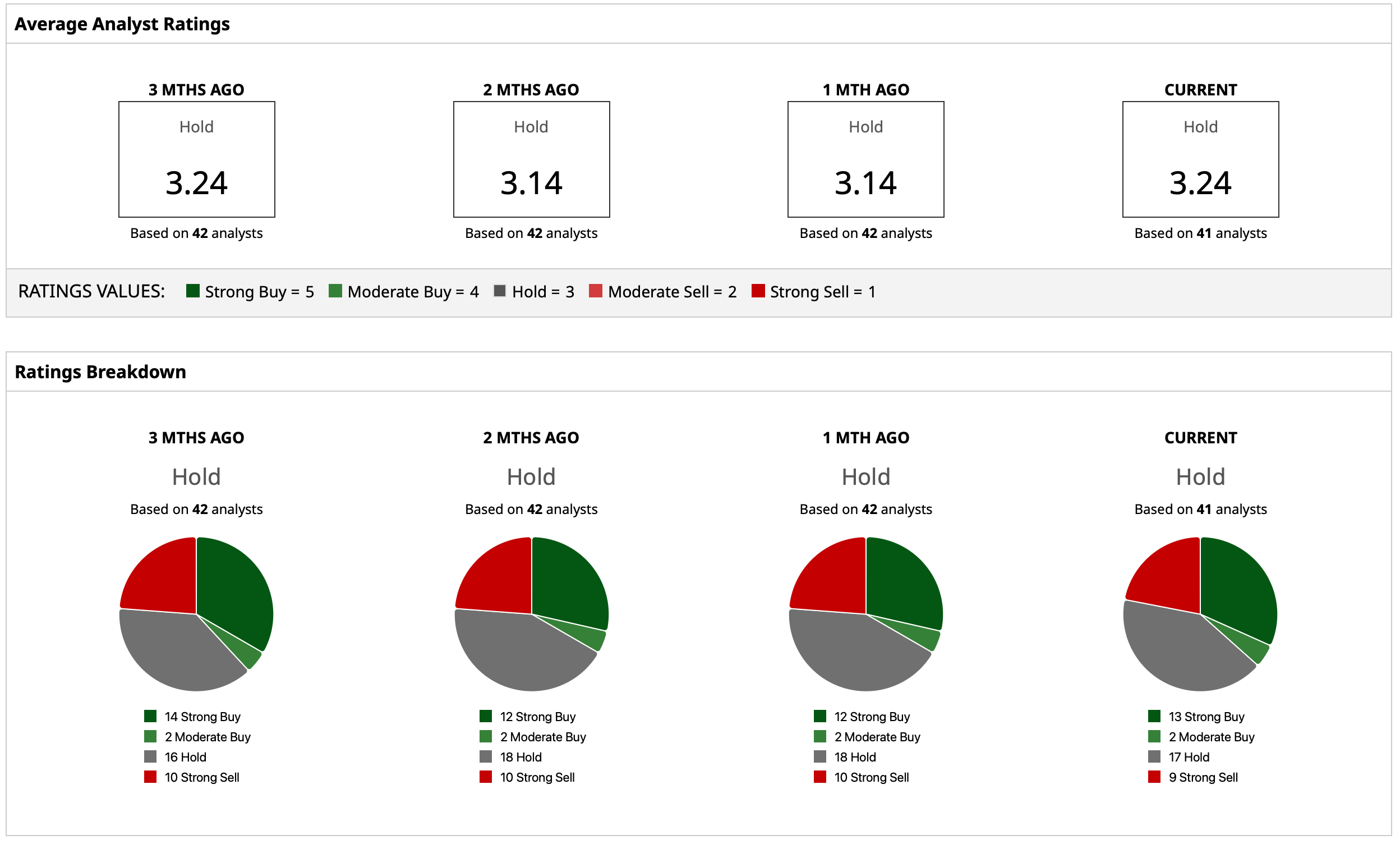

The Here and Now Are the FinancialsTesla is slated to report its Q3 2025 results on October 22. Analysts are expecting Tesla to report an EPS of $0.37 in the quarter, which would imply a year-over-year (YoY) drop of 40.3%. Poring over the Q2 2025 results, total revenues settled at $22.5 billion, a figure that denoted a 12% contraction compared to the corresponding period a year ago. Earnings came in at $0.40 per share, which represented an even steeper YoY decline of 23.1%. Encouragingly, however, this specific earnings per share result did manage to precisely align with the consensus estimates from analysts—a level of performance that had been absent in the two fiscal quarters immediately before this one. Operating margins experienced a significant erosion, retreating to 4.1% in Q2 2025 from the 6.3% recorded during the comparable quarter of 2024. Net cash generated from operational activities also decreased, registering $2.5 billion, a 30% fall when compared on a YoY basis. Despite this outflow, the company concluded the period with a robust cash balance totaling approximately $37 billion, marking an increase of roughly 20% over the $30.7 billion balance held twelve months prior. Notably, this cash reserve comfortably surpassed the company’s current short-term debt obligations, which stood at $30 billion. While total vehicle deliveries saw a decline of 13% from the previous year, settling at 384,122 units in Q2 2025, several metrics related to key infrastructure showed positive advancement. These are the metrics holding potential as significant future value drivers for Tesla. Specifically, the network of Supercharger stations and their connectors expanded meaningfully, increasing by 14% and 18% YoY to reach totals of 7,377 stations and 70,228 connectors, respectively. Analyst OpinionTaking all of this into account, analysts have assigned a rating of “Hold” for TSLA stock with a mean target price of $334, which has been surpassed. However, the high target price of $600 denotes an upside potential of about 32.4% from current levels. Out of 41 analysts covering the stock, 13 have a "Strong Buy" rating, two have a “Moderate Buy” rating, 17 have a “Hold” rating, and nine have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|