|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

What You Need to Know Ahead of Mohawk Industries’ Earnings Release/Mohawk%20Industries%2C%20Inc_%20logo%20on%20phone%20by-%20viewimage%20via%20Shutterstock.jpg)

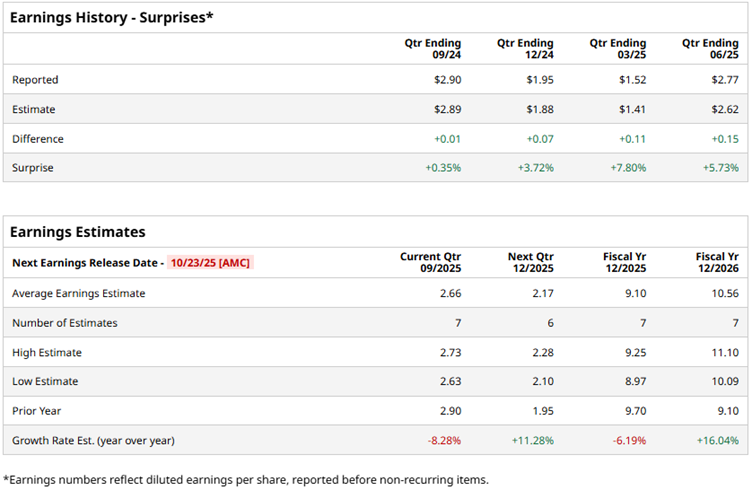

Mohawk Industries, Inc. (MHK), based in Calhoun, Georgia, is one of the world’s largest and most comprehensive flooring manufacturers. The company offers a wide variety of flooring products, including carpet, rugs, laminate, luxury vinyl tile, hardwood, ceramic tile, and natural stone, for both residential and commercial use. Mohawk’s operations are vertically integrated, covering everything from design and manufacturing to distribution and sales, serving markets across North America, Europe, Australia, and beyond with sustainable and innovative flooring solutions. The company has a market capitalization of $8.03 billion. Mohawk Industries is set to report its third-quarter results for fiscal 2025 on Oct. 23, 2025, after the market closes. Ahead of the report, Wall Street analysts show some concerns. For the third quarter, its profit is expected to decline by 8.3% year-over-year (YOY) to $2.66 per diluted share. However, the company has a consistent history of surpassing consensus estimates in its last four quarterly reports. For the fiscal year 2025, Mohawk Industries’ profit is expected to decrease by 6.2% annually to $9.10 per diluted share.  Mohawk Industries’ stock has underperformed the broader market significantly over the past year. Over the past 52 weeks, the stock dropped by 18.3%, while it is up 5.9% year-to-date (YTD). On the other hand, the broader S&P 500 Index ($SPX) has increased by 17.2% and 14.6% over the same periods, respectively. The company is categorically placed under the consumer cyclical sector due to the discretionary nature of its business. The Consumer Discretionary Select Sector SPDR Fund (XLY) has gained 21.1% over the past 52 weeks and 6.9% YTD. Therefore, Mohawk Industries has also been an underperformer in its sector.  The company’s stock gained 4.2% intraday on July 25 after it reported better-than-expected second-quarter results on the previous day. Although its net sales remained more or less flat YOY at $2.80 billion, it was better than the $2.79 billion that analysts had expected. Adjusted EPS dropped by 7.7% from the prior year’s period to $2.77, but was better than the expected $2.62. Mohawk Industries weathered the tariff storm by adjusting its prices and optimizing its supply chain. It continues to operate in an environment that is characterized by inflation and low consumer confidence. However, the company expects the current U.S. trade policy to be beneficial for its operations since roughly 85% of its U.S. sales come from goods produced in North America. Wall Street analysts have been soundly bullish about Mohawk Industries’ prospects. Among the 16 analysts covering the stock, it has a consensus rating of “Moderate Buy” overall. The configuration of the ratings has remained stable, with seven “Strong Buy” ratings and nine “Holds.” The mean price target of $135.50 indicates a 7.4% upside from current levels, while the Street-high price target of $148 implies a 17.3% upside. On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|