|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

Earnings Preview: What to Expect From Nasdaq’s Report/Nasdaq%20Inc%20site%20on%20phone-by%20Tada%20Images%20via%20Shutterstock.jpg)

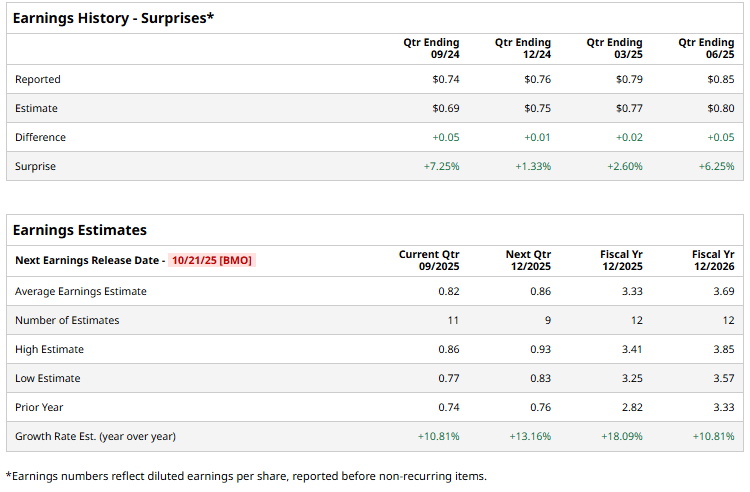

Nasdaq, Inc. (NDAQ) is a global financial services and technology company headquartered in New York City. With a market cap of $50.6 billion, it is a diversified enterprise that owns and operates multiple stock exchanges, including the flagship Nasdaq Stock Market, the Philadelphia Stock Exchange, and the Boston Stock Exchange, as well as seven European exchanges. NDAQ is scheduled to report its Q3 earnings before the market opens on Tuesday, Oct. 21. Ahead of the event, analysts expect the company to report a profit of $0.82 per share, up 10.8% from a profit of $0.74 per share in the same quarter last year. The company has surpassed Wall Street's bottom-line estimates in each of the past four quarters, which is impressive. For the current year, analysts expect NDAQ to report an EPS of $3.33, up 18.1% from $2.82 in fiscal 2024. Moreover, the EPS is expected to rise 10.8% annually to $3.69 in FY 2026.

NDAQ stock has climbed 22.3% over the past 52 weeks, slightly outperforming the Financial Select Sector SPDR Fund’s (XLF) 17.6% surge and the S&P 500 Index’s ($SPX) 17.2% uptick during the same time frame.

Nasdaq’s stock climbed 5.9% following its impressive Q2 results on July 24. The company reported net revenues of $1.3 billion, a 12.7% increase year over year, exceeding analyst expectations. Non-GAAP net earnings rose 23.9% to $492 million, driven by margin improvements, while non-GAAP EPS of $0.85 came in 6.3% above Wall Street estimates. Wall Street analysts are somewhat bullish about NDAQ’s stock, with a "Moderate Buy" rating overall. Among 21 analysts covering the stock, 13 recommend "Strong Buy," three suggest a “Moderate Buy,” and five suggest a “Hold.” The mean price target of $103.61 suggests a potential 17.5% premium from the current market price. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|