|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

Make a 4.5% One-Month Yield Shorting Shopify Cash-Secured OTM Puts/The%20Shopify%20logo%20on%20a%20smartphone%20screen%20by%20IB%20Photography%20%20via%20Shutterstock.jpg)

A Shopify, Inc. (SHOP) cash-secured put option play offers a one-month yield of 4.5%. The put strike price is 7% below Friday's closing stock price. This play has good downside protection, a lower 11% breakeven point, and an attractive expected return (ER). SHOP closed at $161.14 per share on Friday, Oct. 3. The stock is at a peak, so it might make sense for new investors to set a potential lower buy-in point. This can be done by shorting out-of-the-money (OTM) puts.

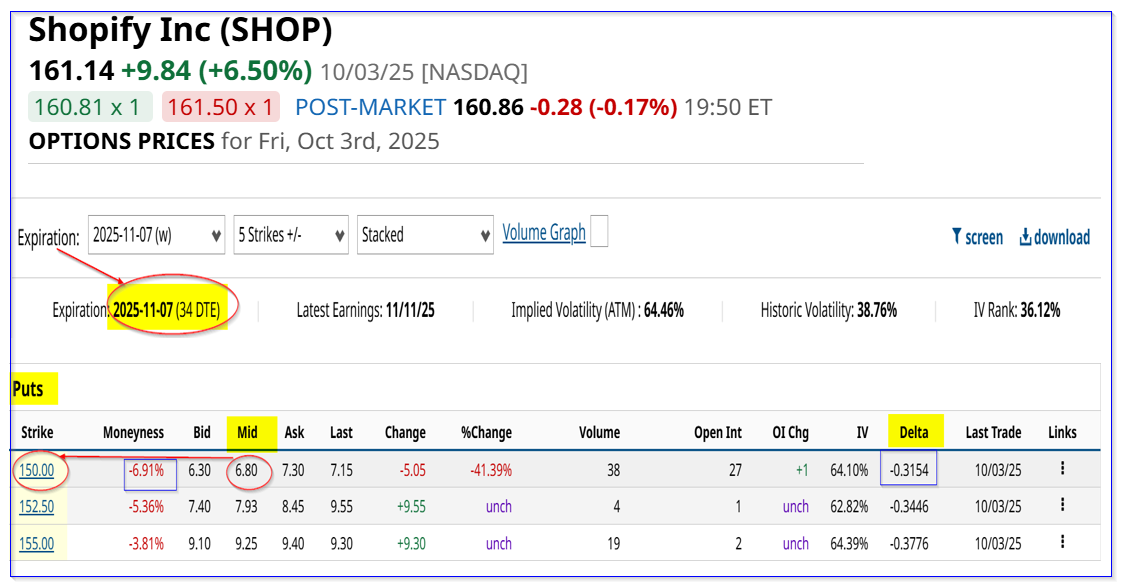

Last Month's PlayI discussed this play a month ago in a Sept. 7 Barchart article, “Analysts Keep Raising Shopify's Targets - Make a 3.0% Yield in One-Month SHOP OTM Puts.” I showed that SHOP stock could be worth $177.58 based on its strong free cash flow (FCF). That was over 20.9% higher than the SHOP's price of $146.82. I recommended shorting the $141.00 put option expiring Oct. 10 for $4.35. for an immediate 3.09% yield ($4.35/$141.00 = .03085). Today, the put premium is just 33 cents, so 92% of that 3.09% yield has been made. It makes sense to roll over this play for another month. But first, let's update our price target for SHOP stock Price Target for SHOP StockUsing the same methodology as in my last article, let's estimate Shopify's free cash flow (FCF) for the next 12 months (NTM) using a FCF margin (i.e., FCF/est. revenue). Then, we divide that FCF projection by an FCF yield metric to set a market value and compare that to today's market cap. For example, analysts now estimate $11.27 billion for 2025 revenue and $13.79 billion in 2026. So, using a ¼ portion of the 2025 number and ¾ of the 2026 estimate: 0.25 x $11.27b + 0.75 x $13.79b = $2.1875b + $10.3425b = $13.16 billion NTM revenue Using an 18.5% FCF margin estimate (i.e., slightly higher than its TTM FCF margin of 18.14%): 0.185 x $13.16 billion NTM revenue = $2.4346 billion NTM FCF Next, let's assume that if Shopify paid out 100% of this FCF to shareholders, the market would give SHOP stock a 1% dividend yield: $2.4346b / 0.01 = $243.36 billion market value That is +16% higher than today's market cap of $209.741 billion, according to Yahoo! Finance. In other words, SHOP stock is worth 16% more: $161.14 x 1.16 = $186.92 That is 5.3% higher than last month's $177.58 price target. Analysts have higher price targets. For example, Yahoo! Finance shows an average price of $163.15, and AnaChart's target is $169.65. Just in case SHOP stock falls, an investor can set a lower buy-in by “Selling to Open” puts in out-of-the-money (OTM) puts. Shorting OTM PutsFor example, the Nov. 7, 2025, option expiration period (approximately a month away) shows that the $150.00 put strike price has a midpoint premium of $6.80 per contract. That means an investor who executes a trade order to “Sell to Open” this contract after securing $15,000 in cash (i.e., $150 x 100 shares per contract), will make $680: $680 / $15,000 = 0.0.4533 = 4.533% over one month

This is even higher than last month's $3.09% yield. In other words, an investor will have made about 7.5% over the past two months. If this keeps up, over the next six months, the expected return is 7.5% x 3 = +22.5%. Moreover, the strike price is almost 7% below Friday's close (better than last month's 4.0% OTM distance). In addition, the delta ratio is lower at 31.5% (vs. 33.8% last month), implying only a ⅓ chance that SHOP will fall to the strike price. If an investor can make 22.5% shorting OTM puts in 6 months, that's better than the expected return of +16% from owning the stock based on our price target. Obviously, there is no guarantee this will happen. In fact, there is a risk of an unrealized loss, if SHOP stock falls to below the breakeven point (i.e., $150-$6.80, or $143.20). That is 11.1% below Friday's close. The point is that this play has a good expected return, but there are risks. Investors can study these risks by watching Barchart's Option Education webinars. The bottom line is that SHOP stock looks undervalued, and this short-put play lowers the buy-in point for new investors. For existing investors, this play can cut the average cost for investors. On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|