|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

This Energy Dividend Stock Just Slashed 2,000 Jobs. Should You Sell Shares Here?

It has been a season of change for big oil, with headlines swirling around production cuts and mounting layoffs. Just days ago, ExxonMobil (XOM) revealed plans to slash 2,000 jobs worldwide, representing approximately 3 to 4% of its total workforce. Despite posting $7.1 billion in earnings last quarter and maintaining shareholder returns of $9.2 billion, ExxonMobil is up against falling oil prices and accelerated consolidation across the sector. November WTI crude (CLX25) recently tumbled to a four-month low, while Brent trades below $66 as global supplies continue to climb at a pace. OPEC+ members are now considering a supply hike of 500,000 barrels per day starting next month, adding even greater pressure to an already crowded market. Will this workforce reduction mark smart cost control or a sign of brewing trouble for long-term investors? Let’s dive into the stock. Numbers Behind the HeadlinesExxonMobil refines, explores, and produces oil and gas while investing in energy projects that shape global consumption and supply. The company’s dividend remains a critical appeal, with a forward annual payout of $3.96 per share, translating to a 3.47% yield. Its most recent dividend distribution was $0.990 per share, delivered to investors on Aug. 15, 2025. XOM has posted a 3.71% gain year-to-date (YTD), though the 52-week performance stands at -8.20%, closing at $111.53 on the most recent session.

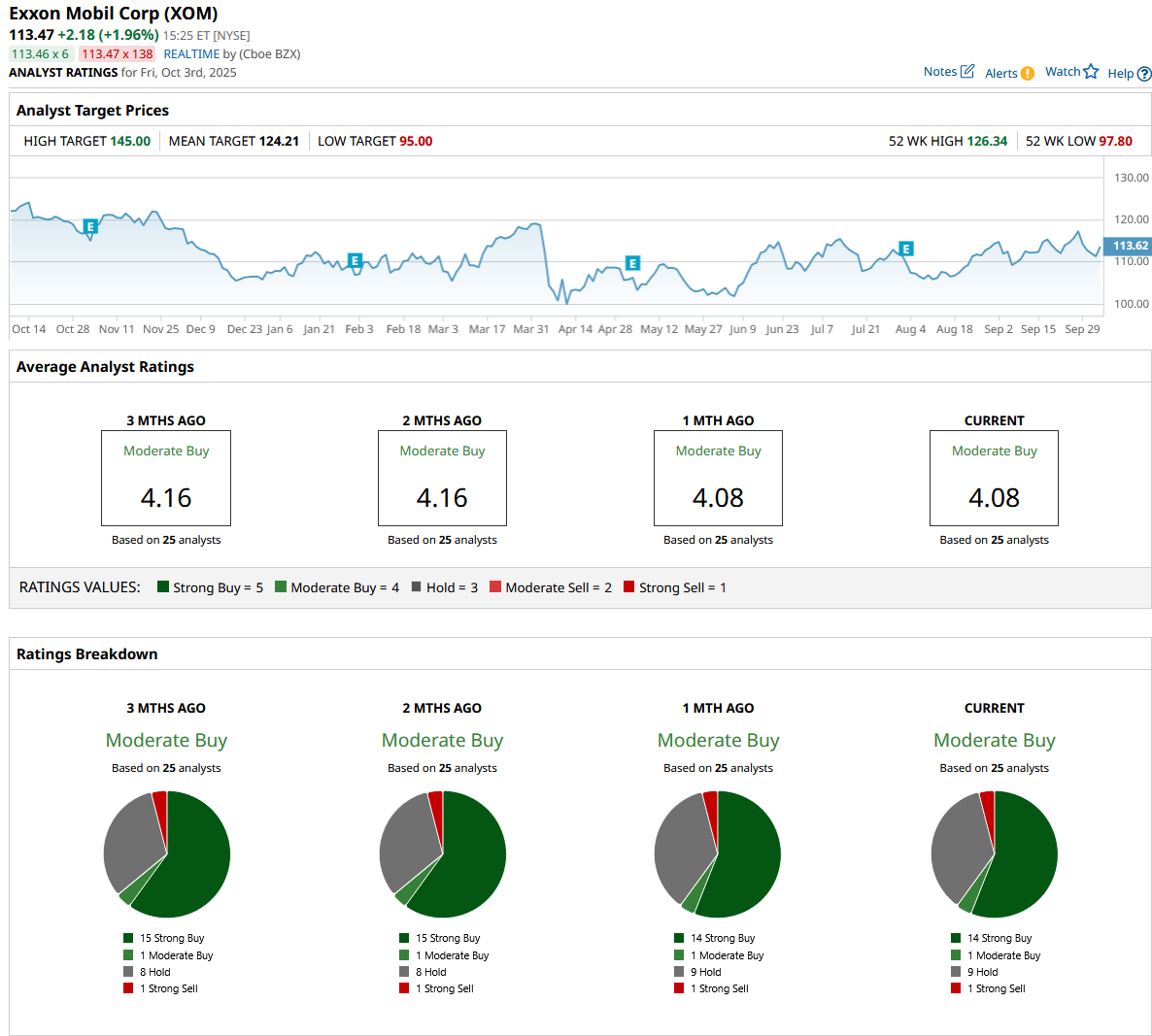

ExxonMobil commands a market value of $480.7 billion, trading at a forward price-to-earnings (P/E) ratio of 17.06 versus the sector median of 12.72x and a PEG of 2.08 compared to the sector’s 1.31x. This suggests investors are paying a substantial premium for ExxonMobil’s profitability and future growth prospects. The Aug. 1, 2025, earnings report showed the company delivering second-quarter earnings of $7.1 billion, equal to $1.64 per share on a diluted basis. This figure highlights robust profitability even as energy markets shift. It reported $11.5 billion in cash flow from operating activities over the quarter. This strong inflow demonstrates the firm’s ability to turn operations into liquid assets. It also generated $5.4 billion in free cash flow, signaling efficiency in covering capital expenses and maintaining shareholder returns. ExxonMobil returned $9.2 billion to investors in the quarter. This payout included $4.3 billion in dividends and $5.0 billion through share repurchases. The company indicated it is on track to purchase $20 billion in shares within the fiscal year. That renewed discipline was evident as ExxonMobil repurchased approximately 40% of shares issued in last year’s Pioneer Natural Resources acquisition since May 2024. ExxonMobil's Strategic Assets Reshaping OperationsExxonMobil’s asset portfolio is getting a serious upgrade. In July 2025, the company and its partner, Qatar Energy International, confirmed a new natural gas discovery in Cyprus at the Pegasus 1 well, found about 190 kilometers southwest of the island and drilled at a depth of 1,921 meters. This find adds to their earlier Glaucus 1 discovery made in 2019, which contains an estimated 3.7 trillion cubic feet of gas. The partnership now holds two key exploration licenses and could be teaming up with Eni (E) and Total (TTE) to develop several nearby deposits. This paves the way for Cyprus to emerge as a larger energy exporter and offer Europe options beyond Russian supplies. Another headline project for ExxonMobil this year is the Golden Pass LNG expansion. The company owns 30% in both the Golden Pass LNG Terminal and the Golden Pass Pipeline. These ventures are in collaboration with QatarEnergy as well. Train 1 is expected to reach mechanical completion and begin producing LNG by the end of 2025. When fully operational, this terminal should be able to export up to 2.57 billion cubic feet per day. With global natural gas demand forecast to climb more than 20% by 2050, the timing lines up with industry trends and opens a lucrative export window for ExxonMobil. Guyana also remains at the heart of ExxonMobil’s prospects. The company is working toward eight offshore projects in the region by the end of the decade. Three are already pumping out about 650,000 barrels per day. ExxonMobil’s team flagged an 11 billion barrel equivalent discovery off Guyana, the largest single find in the last 15 years worldwide. These strategic investments show ExxonMobil is reshaping its operations for the long term, focusing tightly on large-scale, high-return assets even as corporate layoffs signal a leaner structure. XOM Stock's Street Consensus Points HigherThe next round of quarterly results is slated for release on Nov. 7. For the current quarter ending September 2025, the consensus earnings estimate comes in at $1.72 per share. That is down 10.42% compared to last year’s $1.92. The fiscal year estimate for 2025 puts earnings at $6.70, a noticeable 13.99% decline from $7.79 in the previous year, but projections climb again in 2026 by 12.54%, with analysts looking for $7.54. This trajectory means analysts are watching a dip now before what they hope is a firm recovery in the year ahead. When it comes to ratings, optimism still colors the street’s view. The 25 analysts surveyed have issued a consensus rating of “Moderate Buy.” The mean price target stands at $124.21, about 12% higher than the most recent close of $111.29, leaving the door open for meaningful upside if management executes as expected. ConclusionAll things considered, ExxonMobil looks likely to reward patience rather than panic. The company’s fundamentals and project pipeline are solid. Presently, holding shares appears more attractive than selling. If growth and execution keep pace, shares should move higher in the next year. Unless something drastic changes, selling now could mean missing out on a rebound as cost cuts and fresh production assets start to feed results.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|