|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

This Semiconductor Stock Seems Unstoppable

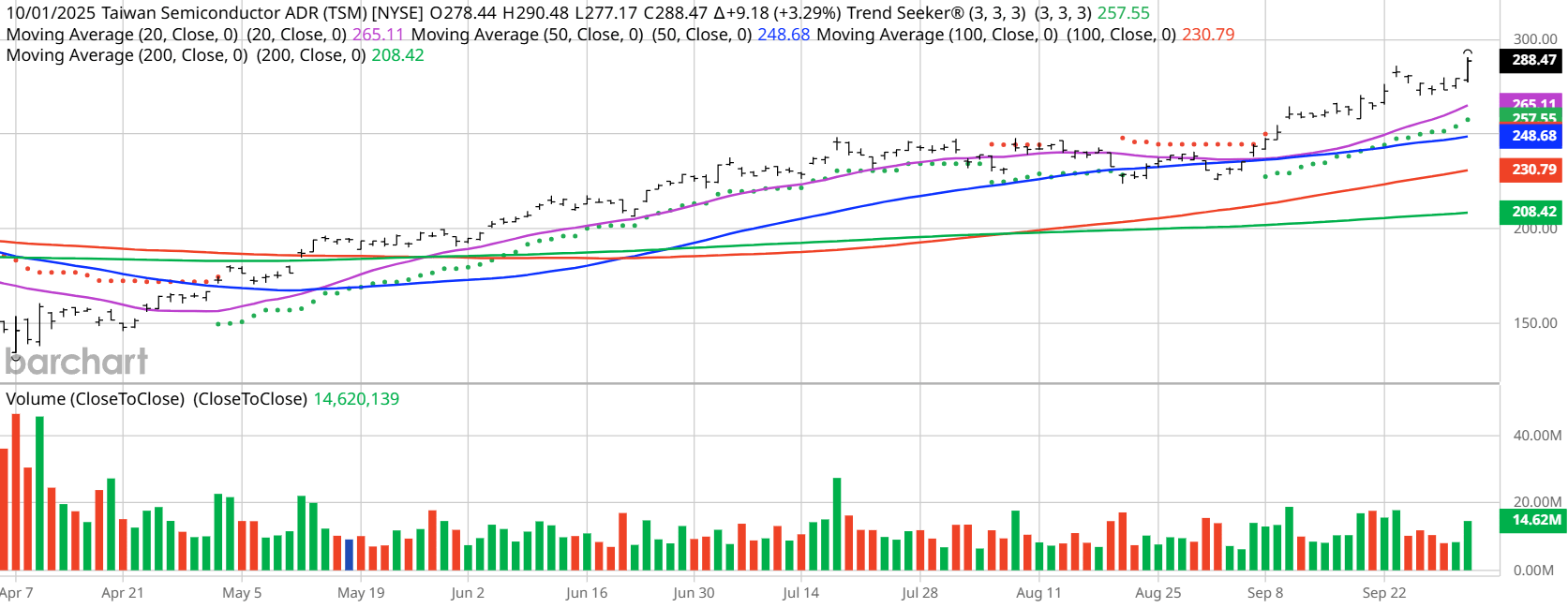

Today’s Featured StockValued at $1.5 trillion, Taiwan Semiconductor (TSM) is the world’s largest dedicated integrated circuit foundry. As a foundry, the company manufactures ICs for its customers based on their proprietary designs using its advanced production processes. TSMC’s goal is to establish itself as one of the world’s leading semiconductor companies by building upon the strengths that have made it the leading IC foundry in the world. What I’m WatchingI found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. TSM checks those boxes. Since the Trend Seeker signaled a new “Buy” on Sept. 9, the stock has gained 15.61%. TSM Price vs. Daily Moving Averages:  Barchart Technical Indicators for Taiwan SemiconductorEditor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock. Taiwan Semi hit an all-time high of $296.72 in morning trading on Oct. 2.

Don’t Forget the Fundamentals

Analyst and Investor Sentiment on Taiwan SemiconductorI don’t buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping stock, it’s hard to make money swimming against the tide. It looks like Wall Street analysts are high on TSM and so are individual investors.

The Bottom Line on Taiwan SemiconductorTSM appears to have backing not only from Wall Street, but also from other financial advisory sites and individual investors. Positive projections of increases in both revenue and earnings are a good sign. From the price targets projected, it looks like it still has room to run. However, geopolitical issues remain a concern Today’s Chart of the Day was written by Jim Van Meerten. Read previous editions of the daily newsletter here. Additional disclosure: The Barchart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance. On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|