|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

Will High-Yield Stocks Ever Compete with the S&P 500 Again? These Dividend ETFs Say the Jury’s Out.

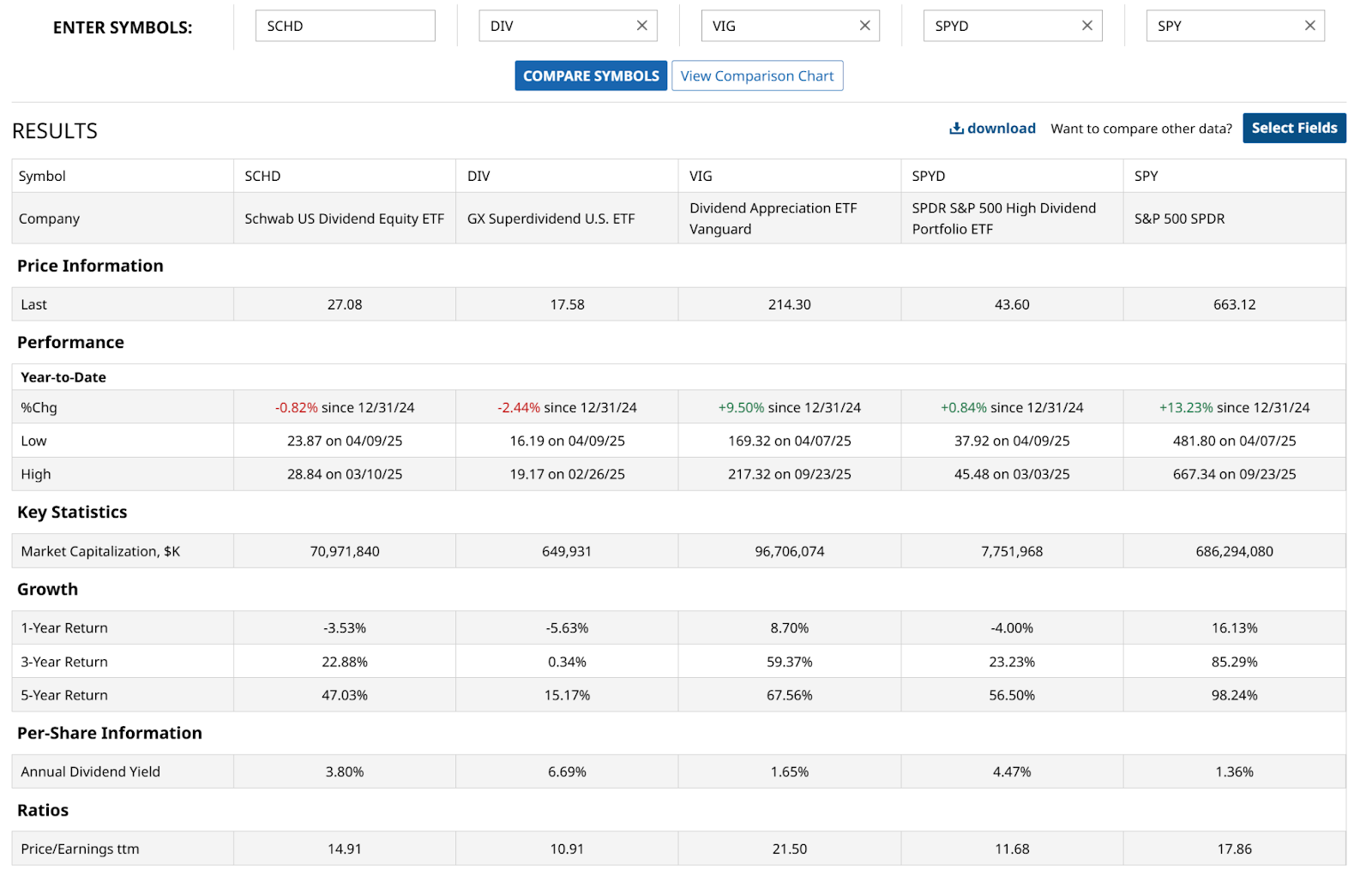

There was a time when dividend stocks were as popular with retail investors as any type of equity investing. In fact, after the twin wealth-destruction periods of 2000-2003 and 2007-2009, many bruised investors shied away from growthier names, barely wanting to touch stocks at all. Fast-forward to 2025, and the script has clearly flipped. The largest U.S. dividend-focused ETF, the Schwab US Dividend Equity ETF (SCHD) has $70 billion in assets under management. That pales in comparison to scores of growth stock ETFs. And while the Vanguard Dividend Appreciation ETF (VIG) is a larger fund at nearly $100 billion, it yields just 1.6%. That’s not far above the S&P 500 Index’s ($SPX) yield, which has been sub-2% for the majority of the past decade. And if yield is the primary motivation, as it is for many retired or near-retirement investors, that’s a tough way to make a living. That has led to a lot of reaching for yield, which historically works until it fails. And when it fails, it can be debilitating both financially and psychologically. That’s because stocks of sound businesses that pay solid dividends can be treated as poorly as high-flyers coming down from overvalued states during bear markets. Until there’s a reckoning that lasts more than the brief ones we’ve had for the past 16 years, this will be just another one of those early warnings that doesn’t stick. So many ETFs have the word “dividend” or “income” in them now that it is not a stretch to say that many investors could have a false sense of security in those securities. Here’s a summary table that shows the potential future turmoil. This does not include dividend returns, so interpret the results as the level of vulnerability a dividend ETF has when the tailwind of ever-higher stock prices finally erodes. As we see, this is already impacting the ETFs that own stocks with higher yields. But for now, those stocks are doing well enough to avoid any alarm bells going off.  In the table, we see that SCHD is doing just fine without the dividend portion of the return. Nearly 9% a year compounded over 5 years (47% cumulative return over that time). However, it is actually down over the past 12 months, such that the yield of 3.8% is just breaking shareholders even for that decline. How long will investors be OK with this? That’s the magic question, to which I don’t have a magic 8-ball to answer. And, while VIG and the SPDR S&P 500 ETF (SPY) have made hefty price returns for the past several years, the recent negative run in the price of the SPDR S&P High Dividend Portfolio ETF (SPYD), which owns the 80 largest yielders in the S&P 500 Index, is another cautionary sign. The Takeaway HereThis is a great time to know three things about your dividend ETF:

Dividend investing has changed because markets have changed. Corporate buybacks replace dividends more and more. And investor appetite for growth has put dividend ETFs in the penalty box, relatively speaking. Don’t expect things to reverse anytime soon. On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|