|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

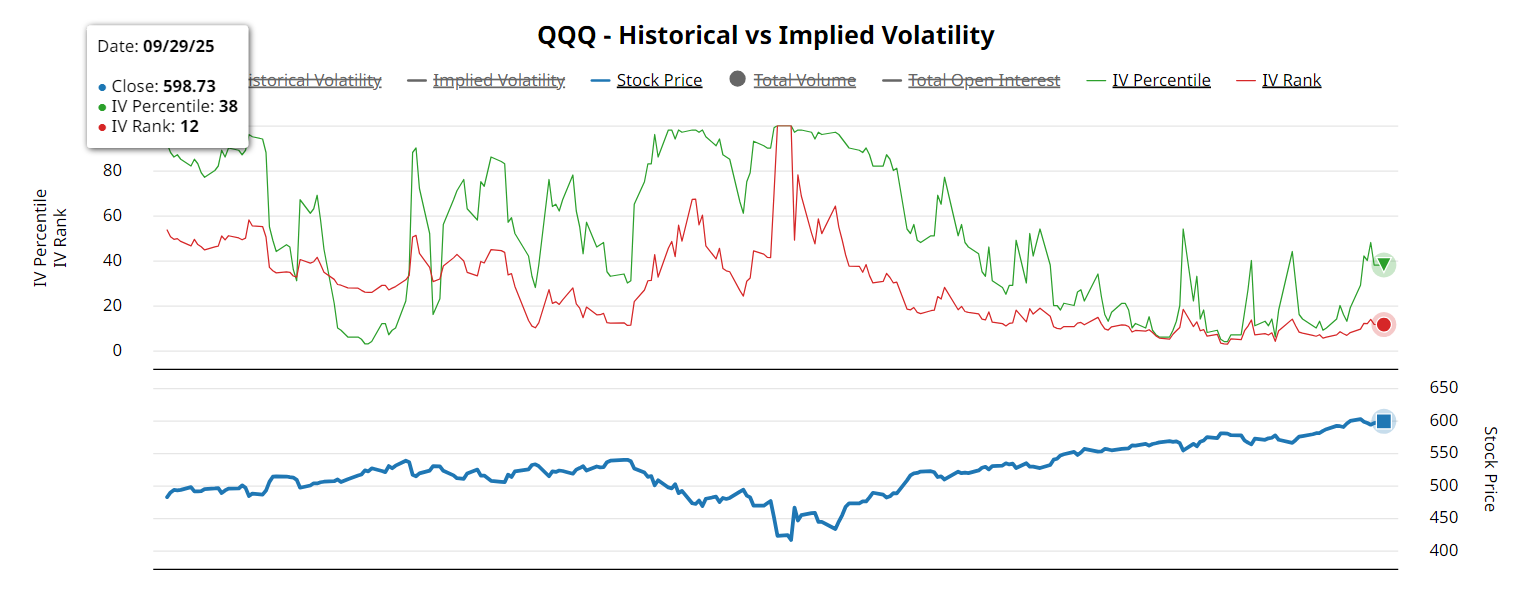

Best Options Trades for Every Implied Volatility Scenario

Implied volatility (IV) isn’t just noise — it’s the heartbeat of the options market. In his latest YouTube video, Rick Orford breaks down how to align your strategy with volatility conditions by using metrics like IV Rank and IV Percentile. Here’s a quick guide from the clip: Long Options: Look for Low but Rising VolatilityWhen volatility is below 50% but trending upward, traders may find opportunities in long calls or puts.

Short Options: Use High but Falling VolatilityCovered calls, cash-secured puts, or spreads like bear calls and bull puts work best when IV Rank and Percentile are above 60–70%, but trending downward.

Debit vs. Credit Spreads

How to Find the TradesBarchart makes it simple to screen for trades by volatility conditions:

For example, searching for lowest implied volatility at the time of recording brought up names like Microsoft (MSFT), Apple (AAPL), Altria (MO), and Caterpillar (CAT) — liquid, well-known companies where long strategies may fit. The Bottom LineImplied volatility isn’t just a number; it’s a roadmap for picking the right options strategy at the right time.

Watch the clip to see Rick’s lesson →

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|