|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

How to Generate Bond-Like Returns and Big Upside Potential from an Ethereum ETF

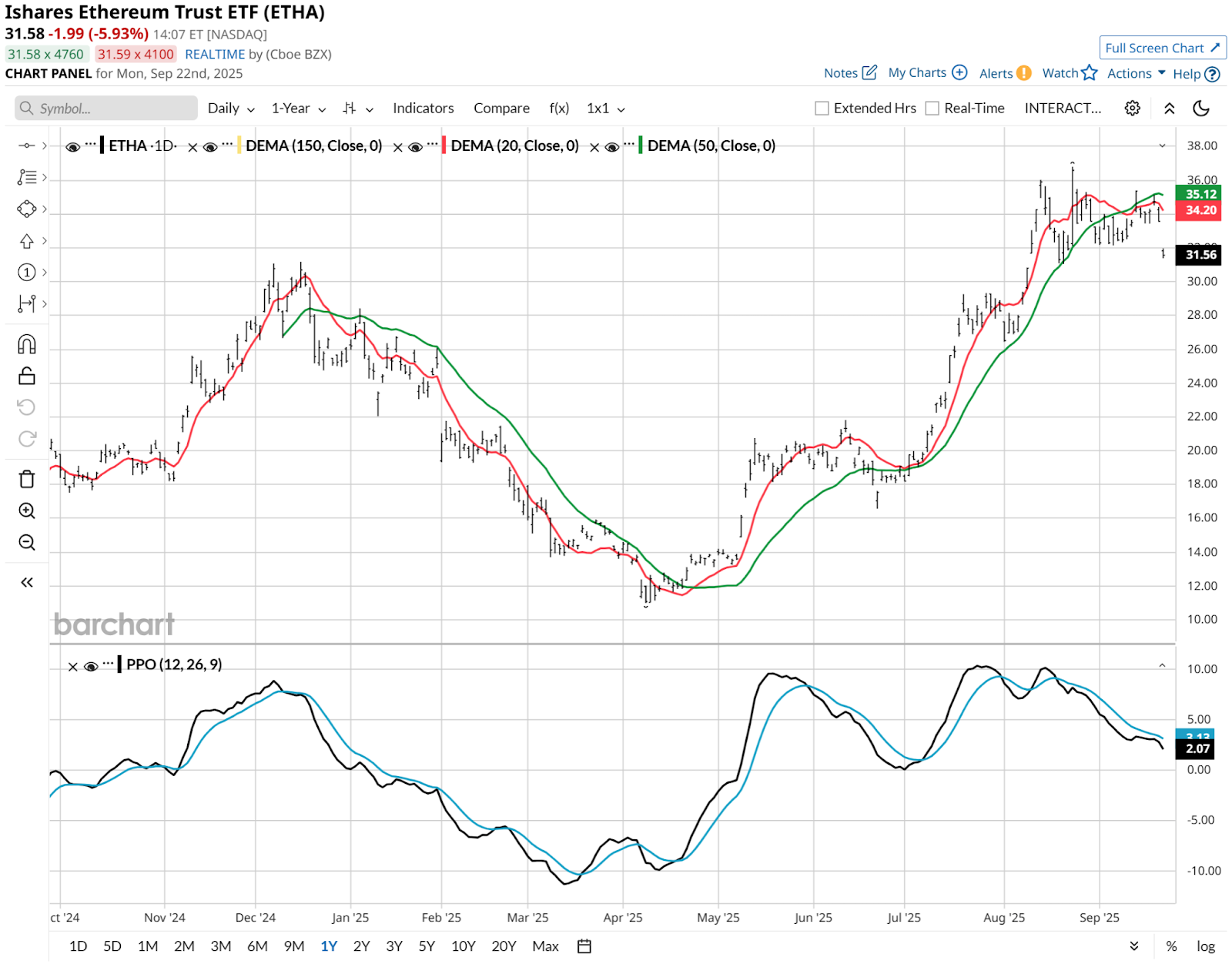

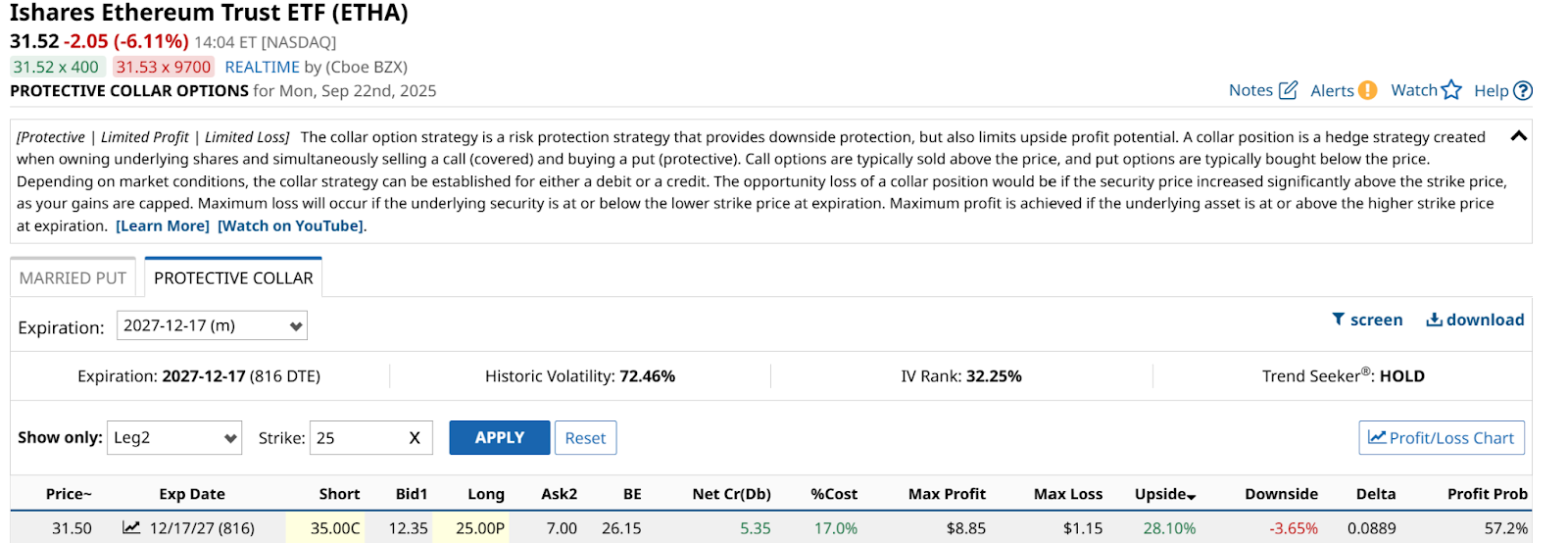

If you’re like me, you love the idea of cryptocurrency ETFs, but not because you can explain terms like blockchain, distributed ledger, tokenization, or smart contracts. Instead, you love them because there is so much activity and liquidity surrounding the public market presence of these volatile vehicles. If you are a trader, anything that moves, in either direction, can at least be considered for a potential trade. I suspect there are many people trading Ethereum (ETHUSD) who do not understand it in detail. In that sense, activity in a 15-month old, $16 billion ETF that tracks the price of Ethereum, the iShares Ethereum Trust ETF (ETHA), is not very different from trading in smaller, unproven stocks with a “great story and potential growth.” However, Ethereum is a real business, and its applications to the real world are getting more legit every year. That doesn’t mean it won’t tumble in price, temporarily or longer term. But it does create some interesting considerations for traders. Since late June of this year, ETHA is up more than 70% through last Friday’s close, a more than 10x gain versus the iShares Bitcoin Trust ETF (IBIT), the largest spot bitcoin ETF, issued by the same ETF giant.  This brings ETHA to an interesting juncture to say the least. Its price has appreciated to the point where technically, it is at best tired, and at worst set up for a significant decline. This daily price view shows a quick dive to start this week, and the Percentage Price Oscillator (PPO) indicator at bottom has a strong hint of “overvalued” to me. If you look at the left side of this chart, starting this past January, the last 50% drop in ETHA occurred with a PPO pattern very similar to the present one.  ETHA only goes back to last year as a trading vehicle. So to get a better sense of where it has been longer-term, I took the liberty of using an ETF that was trading years before spot-price crypto ETFs were a thing. Here’s a weekly chart. The volatility in this asset type is evident.  Using Options to Create a Bond-Like Scenario, But BetterAt this point, I suspect there are two types of investors in ETHA. The first is those who have been in and love the gains they have made recently. And the second those who either bought recently or are thinking about it, possibly with a big dose of FOMO. For both types, here’s a way to consider taking that high-octane upside of Ethereum’s spot price, and turning it into a bond-like return stream. That’s right. I said “a bond-like return stream.” Because sometimes, I spot option collar setups that look great to hedge a stock I want to keep owning, thinking it can keep rising. But I don’t want to lose what I’ve made. In the case of ETHA, I’m flipping that script. Not 180 degrees, but maybe 90 degrees. Here’s a snapshot look as of Monday mid-day of a collar I picked out as a sample for how this could work.  The Data Points to a High Potential Reward with Low Risk

Collaring ETHA Isn’t Popular, But Maybe It Should BeI have that 28% to under 4% up/down potential over 27 months, but I receive as much up front as I’d make in a bond yielding around 7.5% for 2 years and 3 months. There’s some downside risk if ETHA falls. But it could fall all the way back to $12 and I could still sell it for $25 a share, any time during the next couple of years, through that expiration date in late 2027. I’m not saying this is something many crypto fans are likely to look at. Bond investing is not exactly popular with the crypto crowd. However, it is good to know that the volatility of Ethereum can be exploited in a way that can bring in a rush of cash flow now, and keep a lid on major losses. On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|